In our ongoing efforts to ensure accuracy in media reporting on bitcoin, I have collaborated with the Digital Assets Research Institute (DARI) to craft a comprehensive rebuttal. This response addresses inaccuracies in a misleading article published by the BBC on 30 November 2023, and the subsequent inadequate handling of my initial complaint.

Below, we dissect these interactions and clarify the reported inaccuracies.

Understanding the context of the BBC's response to the initial complaint is important. Their reply, which dismissed the substantial evidence provided, demonstrates a lack of engagement with the facts and expert analysis. You can access the full text of the BBC's response in the tweet below:

Rebuttal from Digital Assets Research Institute (DARI)

Introduction to this Response

On 30 November 2023 the BBC published an article titled: Every Bitcoin payment ‘uses a swimming pool of water'; authored by Chris Vallance. The article paraphrases a recent (at the time) publication by well-known Bitcoin critic Alex de Vries.

Subsequently, journalist Susie Violet Ward filed a complaint to the BBC citing inaccuracies and misinformation in both the article and the source publication. In September 2024 she received a reply that amounted to a refusal to acknowledge the flaws in the publications. Both Susie and the team at the Digital Assets Research Institute (DARI) consider the points made in the response insufficient to justify the dissemination of mis-and/or-disinformation to the public.

Our proof of work follows. We invite one of two things. First and preferred is the retraction of any and all reporting of Alex de Vries debunked publications (a list is available on request), or a response that outlines that our positions as taken below are in some way incorrect. We welcome the discussion, data, and proof of any mistakes we might have made.

Yours, Susie Violet Ward, Dr Simon Collins, Dr Jan Wüstenfeld, Dr Rian Dewhurst, the team at DARI.

BBC Claim:

We interviewed Mr de Vries about his findings. His article was peer-reviewed and additionally we contacted a number of other parties and included excerpts from their comments to represent a range of views.

Our Response:

We’d like to draw attention to the “class” of articles we are discussing. De Vries 2024 article on water consumption was published as a “commentary” paper. This is a very different standard of publishing to a research article. It would benefit the BBC to familiarise itself with these distinctions. Here’s is a summary of the difference: “A commentary article expresses the author's subjective views on a topic without introducing new research, whereas research articles present original studies with empirical data.” (Aiche, 2024).

Commentaries are not held in the same esteem as other journal articles (Rocky Vista University, 2022). There are a few reasons:

Commentaries are shorter and less rigorous. Commentaries do not typically involve the same level of original research. In this instance, as will be discussed later, this article by de Vries hardly constitutes a rigorous undertaking of methodologically sound research. It is instead an under-referenced opinion piece.

Commentaries are more subjective. Commentaries often involve the author's own interpretation, and they may be more likely to express personal opinions or beliefs. This can make them less objective than research articles.

De Vries makes no effort to hide the subjective nature of his opinions in this instance. His perspective provides the starting point for the evidence he presents supporting his case.

Commentaries are less likely to be peer-reviewed. Commentaries are often not peer-reviewed in the same way that research articles are. This means that they may not have been subjected to the same level of scrutiny, and they may contain errors or biases. With no methodology and no basis in a field of study this article is very much an unsupported opinion piece. The scrutiny any editor or reviewer gave it is likely far less than a research article and thus it’s not a reliable piece of science or theory development.

Critically, a commentary expresses subjective views, without introducing new research. Raw calculations, without methodological context, process, and discussion of limitations of the methods are not new knowledge. Ultimately, we believe that the BBC may have erred in presenting this information as more objectively factual than it really is.

BBC Claim:

Mr de Vries'; central calculation of the amount of water used by Bitcoin is supported by the prior findings of other researchers e.g.https://doi.org/10.1016/j.jclepro.2023.137268

Our Response:

We appreciate that the BBC has provided a research paper in an attempt to validate de Vries’ claims. However, we find several concerning issues with the cited paper. First, the paper references de Vries prior commentary work extensively throughout. This undermines its value because the papers that Siddik, et al. (2023) rely on to base their figures for energy consumption, carbon emissions and water consumption are, again, not based on rigorous analysis and not subject to the same standard of peer review as research paper.

Notably, the methods used have significant flaws that, again, reinforce that there is little value in the arguments made here.

Flaw: The study relies heavily on assumptions due to incomplete or unavailable data, such as assuming that Bitcoin';s geographic distribution mirrors that of lesser-known cryptocurrencies. Additionally, energy consumption for banknotes was extrapolated from a U.S.-specific study, which may not be representative for other countries. Impact: These assumptions introduce uncertainty and can skew results, particularly in cases where regional variations in energy intensity or cooling technologies are significant.

Flaw: The study uses continental averages when country-level data is unavailable, especially for cooling technologies in power plants and direct water consumption in bank branches. Impact: This can obscure important country-level differences. For example, hydropower in some countries might have vastly different water footprints than in others due to evaporation rates, making continental averages less reliable.

Flaw: The study assumes that all cryptocurrency mining is powered through national electricity grids, disregarding the possibility of off-grid renewable energy or privately operated power plants by mining operations. For example, in 2024, we are well aware that 21.44% of Bitcoin mining is conducted off grid and that 75.1% of that uses zero-emissions sources (Batten, 2024).

Impact: Failure to accurately measure the mix of energy sources undermines any conclusions a study could make about energy use and emissions intensity.

Flaw: The study uses U.S. Department of Treasury data to estimate energy and water use for printing banknotes globally, which may not reflect the processes or efficiency of other nations'; currency production. Impact: This risks overstating or understating the environmental burden of conventional currencies in other regions.

Flaw: The paper does not conduct a sensitivity analysis to examine how variations in key parameters (e.g. energy mix, cooling technologies, cryptocurrency adoption rates) would affect the results. Impact: It is difficult to gauge the robustness of the conclusions without understanding the sensitivity of the results to different assumptions and data inputs.

Flaw: The study relies on data from 2021 or earlier for both conventional and cryptocurrency financial systems, which does not capture the latest trends in energy efficiency, mining technologies (e.g. Ethereum';s shift to proof of stake), or the increased adoption of cryptocurrencies.

Impact: This makes the results less applicable to current conditions, particularly in a rapidly evolving field like cryptocurrency.

To summarise, the research provided as “validation” of de Vries’ work is more of a proxy for similar inferences—drawn from commentary rather than meeting the standards of empirical research.

The findings of the paper are also in conflict with more recent science that demonstrates that bitcoin mining has significant environmental benefits including:

Balancing electricity grids to reduce load variability and the reliance on high-emitting gas, oil and coal peaker plants (Carter, 2021; Mellerud, 2021).

Incentivising and monetising the deployment of renewable electricity generation (Bastian-Pinto et al., 2021).

Mitigating methane from landfills (Rudd et al., 2024).

Reducing the vented flare gas from oil refining (Decker, 2021; Snytnikov; Potemkin, 2022; Vazquez; Crumbley, 2022).

Enabling the transition from diesel-electric powered islanded microgrids to

renewable generation (Hajiaghapour-Moghimi et al., 2024).

BBC Claim:

Mr de Vries also illustrated the scale of this result by suggesting that every Bitcoin transaction uses, on average, enough water to fill “a back yard swimming”.

This calculation is in the published paper:

https://www.sciencedirect.com/science/article/pii/S2949790623000046

“With the network handling 113 million transactions in 2020 and 96.7 million in 2021, the water footprint per transaction processed on the Bitcoin blockchain for those years amounted to 5,231 and 16,279 L, respectively.”

Our Response:

De Vries’ findings and their reproduction in the BBC as factual findings is, of course, the crux of this particular complaint. There are significant methodological issues with the article that suggest it is unfit for reproduction in mainstream media and is not a “research” article that can be reasonably treated as factual, nor used as the basis for further development of theory.

Crucially, the paper reports no “methods”. Methodology is the core of good science and critical to the generalisability and reproducibility of the results of findings. De Vries makes several assumptive, raw calculations and arrives at a staggering result. He doesn’t disclose the calculations, and the results are not moderated by any statistical tests to normalise the findings. Generally, a paper that contributes to science would follow a process of generating descriptive statistics, hypothesis testing, tests for relationships between variables, model fit and diagnostic tests, robustness, sensitivity analysis, validity and reliability tests, to ensure the results are valid (Park et al., 2020).

A paper should also be positioned within a field (Sai & Vranken, 2023). This mean that it is building on an established set of accepted principles and methodological standards. De Vries does not position his work in any field which means we cannot corroborate his findings by comparing them to similar work. We’re just expected to take him at his word. Couching research within an existing field of study offers a range of benefits, including providing a set of acknowledged methodologies to use – avoiding the need to create one from scratch, and offering a pool of qualified collaborators, reviewers, and editors whose input lends credibility, insight and useful advice to researchers looking to make valuable contributions to their area of study.

Alex de Vries has opted to forego all of this to instead position his article in what amounts to a methodological void.

BBC Claim:

The complaint suggests Cambridge University researchers have criticised Mr de Vries'; underlying methodology but provides no further detail.

Our Response:

We will gladly clear up the need for more details regarding de Vries methodological Poverty.

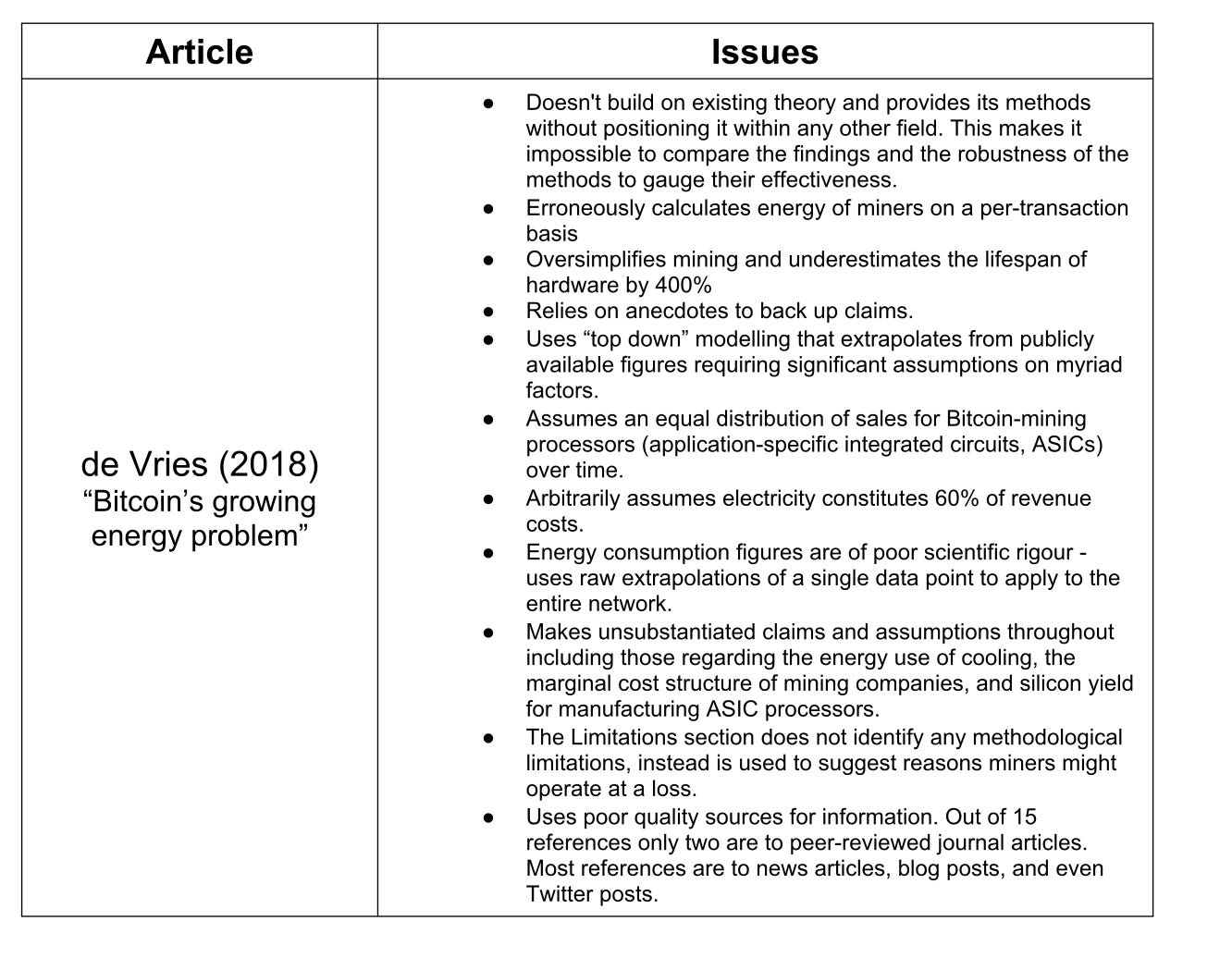

Alex de Vries’ “calculations” of energy consumption are fundamentally flawed, extensively overstated, and widely and wholly refuted, debunked and left wanting by a growing field of empirical research. The accumulated refutation of his work to date is available in Collins &; Dewhurst (2024). Still, just to make sure you can see the extent of the misinformation being peddled here, we attach a list of the mistakes, methodological errors, and misinformation in the article Mr de Vries uses to base all assumptions on going forward: his 2018 commentary article in Joule entitled

Bitcoin’s Growing Energy Problem (de Vries, 2018).

Details of how this particular article - “Bitcoin’s growing water footprint” is methodologically unsound, are discussed here:

Direct Water Use

De Vries uses a widely debunked (Paez, 2023) New York Times article to calculate the direct water consumption of Bitcoin mining. The first error is conducting a 1:1 comparison of the water use of data centres of various sizes, and “combining” it with a list of 34 Bitcoin mining operations. Assuming that Bitcoin data centres are cooled the same way as conventional ones - which are liquid cooled more frequently than Bitcoin mining operations. He then makes a set of unverifiable claims about their power consumption (because he doesn’t provide a reference of where he got the information about their hash rate, nor where the power use data came from). He uses data from the Cambridge Centre for Alternative Finance (CCAF) to calculate the distribution of miners. Putting aside the fact that the CCAF’s data is up to four years out of date, he claims a date of access is impossible because the US data ended in December 2021 (CCAF, 2024), but he claims his figures are from January 2022.

Then he goes on to provide details for how much water they used by applying what a regular data centre would use if it consumed that much power - 0.25 to 1.03 L per kWh – a variance between upper and lower bound of 312% - an exceedingly high spread. We conducted a quick survey of the Luxor.tech ASIC Request for Quote platform and examined the recent closed tenders. Of 24,497 machines sold accounting for 4,167,025 TH across 90 tenders none were water cooled. Most manufacturers didn’t offer a water-cooled model until 2023. And the specialised hardware required for water-cooling is far more expensive to deploy. Immersion mining is arguably a larger portion of the market. They’re also immersed in mineral oil, which is cooled using heat exchange, not water. So, while de Vries manages to find a direct consumption figure of 8.6–35.1 GL, putting aside another exceedingly wide band of upper and lower bounds, the real figure is likely so small it hardly bears mentioning. It’s also important to point out that Bitcoin mining is overwhelmingly air-cooled and to the best of our knowledge and despite an attempt to find any examples, does not appear to use any “humidification”.

De Vries fails to mention that hydro cooling, while employed in a minor proportion of all mining, has several notable benefits that run counter to his regular narrative. Firstly, it reduces the overall energy consumption of a mining computer due to lower temperatures overall (Naueihed, 2023) (ASIC chips are more efficient at lower temperatures (Shukla, 2022)). Water cooled ASICS last longer due to reduced wear and tear, operating more efficiently and profitability. Mr de Vries characterises ASIC computers as a “churn and burn” commodity that are being disposed of every 16 months (Sai & Vranken, 2023), so superior cooling that extends lifespan while temporarily withdrawing water only works for one of his arguments at any given time

(Ludwig, 2023).

Indirect Water Use

We acknowledge that water poverty is a significant global issue. Millions of people around the world lack access to safe drinking water, and the risks to stable water supplies caused by climate change are not to be underestimated. But Alex de Vries has attempted to weaponize this sentiment as he prosecutes his unwarranted grudge against Bitcoin. Let’s dig into where he goes wrong (again) on this topic.

In the article generally, but particularly in the section on indirect water consumption the paper either deliberately or ignorantly confuses water withdrawal with water consumption to make its claims more impactful. During the generation of electricity, whether hydroelectric, thermoelectric or other forms, not all water withdrawn is consumed (Macknick et al., 2012). By conflating the two, the article exaggerates the extent of the environmental impact. For clarity:

Water consumption is the permanent removal of water from the pool of available water. It’s either kept permanently by being used up somehow or becomes so polluted it cannot be returned to the water cycle.

Water withdrawal is the temporary removal of water from the available supply which is returned after use. In the United States, for example, water withdrawal from electricity generation is the source of nearly 50% of all freshwater withdrawal (Kumar & Yaashikaa, 2019).

In the article, de Vries consistently conflates the two terms when they are convenient to the point he’s making. For example, he states: "Hydropower generation generally consumes even more water per kilowatt-hour (kWh) generated, as water evaporates from the hydropower reservoirs." Evaporation from hydroelectric reservoirs has been found to be overstated (Bakken et al., 2013; Scherer & Pfister, 2016) given it generally evaporates in dry seasons and is returned in wet ones. In fact, these water storage facilities, whether man-made or natural, are seen as contributing to the abatement of water scarcity in the regions they are located (Hydro Review, 2014; World Meteorological Organisation, 2009). Ultimately, is there an evaporated volume of water per kilowatt hour? Yes. Is that evaporation the same for electric cars, breweries, hospitals, houses and aluminium smelters? Also yes.

Elsewhere he says, "Thermoelectric power generation plays a major role in water consumption, as a portion of the withdrawn water for cooling purposes evaporates (unless dry cooling technologies utilising air are employed).". Again, here, the term “water consumption”; is used, but much of the water used for thermoelectric cooling is withdrawn and then returned to its source (albeit at a higher temperature), not permanently "consumed." (U.S. Geological Survey (USGS), 2019). Modern thermoelectric water consumption is measured at 1% of the withdrawn water for once though cooling (Water Resources Mission Area, 2019). Evaporative cooling where water is “consumed” though evaporation into the atmosphere is increasingly rare in modern thermoelectric electricity generation. Kazakhstan, discussed in detail below is a country with some of the oldest thermoelectric power generation systems in the world. Despite this, once through is still substantive proportion of the cooling used in that country.

The article states: "The water consumption by Bitcoin miners in Kazakhstan alone amounted to 260.6 GL in 2020 and rose to 997.9 GL in 2021, a 283% increase.".

However, this is unverifiable due to a lack of references. This refers to indirect water consumption tied to electricity generation for Bitcoin mining. However, this large figure likely refers to water withdrawal (the total amount of water used for electricity production), not consumption (the amount lost through evaporation).

Again, conflating the concepts where it’s convenient. To check his figures, we conducted our own calculations. The total installed electricity generation capacity of Kazakhstan in 2021 was 24GW (International Trade Administration, 2022) and peak Bitcoin consumption was 1.5GW – approximately 6.25% of all energy generated (Mellerud, 2023). Evaporative cooling comprised approximately 4340GL of water consumption at power plants and 3556.73GL for once-through (Rivotti et al., 2019) (we extrapolated their data to get this number). So, Bitcoin mining used 273.4GL (6.25% of Evaporative and 1% of 6.25% of Once through cooling) of water in indirect consumption in 2021 – the peak year. Alex de Vries unfounded calculations are overstated by 365% in the most water-intensive jurisdiction he could find.

Indeed, De Vries’ analysis relies heavily on figures for Kazakhstan which he claims likely has 14% of the network hash rate and above-average water consumption.

However, in 2023, Kazakhstan had less than 4% of the network hash rate (Mellerud, 2023) so the figures invoked in this article are skewed by 350%. We note that de Vries is referring to the 2021 figures, but when the article is named “Bitcoin’s growing water footprint” the point does not stand up to the terms of the article. Instead, the current measures suggest that the water footprint is shrinking.

The fact of the matter is that none of the claims made about the indirect water consumption that de Vries makes are trustworthy due to his consistent, deliberate, and strategic attempts to paint the use of energy and water by Bitcoin as something more than it is.

Summarising the last two responses is rather simple. As the late, great Christopher

Hitchens once said:

"what can be asserted without evidence can also be dismissed without evidence"

(Ratcliffe, 2016)

Alex de Vries has offered no methodologically sound, or verifiable proof of his claims. In fact when we conduct the same calculations we arrive at a fairly consistent over-statement of several metrics by 3.5 times. We, as you should, dismiss de Vries’ claims as unverifiable and likely untrue.

BBC Claim:

We believe this MAY relate to a 2018 Global Cryptoasset Benchmarking study by six Cambridge researchers challenging the meaningfulness of comparisons of energy use between Bitcoin and traditional payment systems. It notes that potentially thousands of payments can be made with one Bitcoin transaction via the Lightning Network.

We have asked Mr de Vries about this. He told the BBC in his view the actual scale of lightning payments is not likely to be large enough to render per-transaction calculations meaningless - and he notes per-transaction figures now feature in European regulatory technical standards on crypto (see

https://www.esma.europa.eu/sites/default/files/2024-071ESMA75-453128700-1229_Final_Report_MiCA_CP2.pdf)

We would have had no reason not to report his statements about water consumption per transaction.

Our Response:

Mr de Vries frequently uses this approach. The division of some metric – power use, carbon emissions, e-waste, and now water – by the number of transactions in the average block of Bitcoin transactions. Despite the fact that there is a significant, and growing literature in the public domain that discusses why Bitcoin doesn’t use electricity, or any other resource on a per transaction basis (Dittmar & Praktiknjo, 2019; Masanet et al., 2019; Sai &; Vranken, 2023; Sedlmeir et al., 2020). This is not (as suggested in the complaint response) anything to do with the Lightning network’s ability to bundle any number of side-chain transactions into one or two base chain transactions - although that is also true. It is because this is just not how the network works.

The Bitcoin network uses energy to hash blocks no matter how many transactions are included in that block (Carter, 2021). Fact is, that the network would use the same amount of energy if the block had one transaction in it or 10,000. Miners and nodes run the network for different incentives. Wallet software sends transactions while expending effectively no power (Khazzaka, 2022). Bitcoin transactions are sent from any number of different types of devices – including mobile phones, laptops, even via radio and feature phone text message. None of these devices could compete with a mining ASIC for energy use and still manage to broadcast transactions for inclusion in the next block. Put simply, individual transactions do not use energy, and more transactions on the network would not use more energy. The same can be said for other claims made about Bitcoin’s resource use per transaction; if the number of transactions increases, the network will not use more water, copper, silicon, carbon, or even (according to one ludicrous claim) human lives.

Why does mining use energy then? The energy miners use secures the entire historical record of transactions so that nobody can alter it - remember Bitcoin is finite and scarce. If one Satoshi is in the wrong place, or in two places at once, the whole thing doesn’t work. That’s what makes bitcoin quite an incredible system - after nearly 15 years every single 100,000,000th of every single 18,000,000+ bitcoins is exactly where it’s supposed to be. During the process of hashing a block, miners do arrange new transactions in the next block in order to fit as many in as possible with the space available, which leads to the misconception that this energy is used to process transactions (River, 2024). At the time the block is hashed and the block header (the solution to the last block plus and other key information) is signed into the next block, every transaction in the history of Bitcoin is reconfirmed (Puranam et al., 2019) - the current and past state of every Satoshi, of every Bitcoin, and every move it has ever made.

Furthermore, the energy use of Bitcoin means that no individual, or coordinated group could get together to prioritise their own transactions (sent for no energy but hashed into a block) that made the blockchain inconsistent. It uses energy to protect the integrity of 1.3 trillion USD of asset value.

So, whether water, energy (or any future metric conceived by Mr de Vries) is used as the numerator, putting the number of transactions in the bottom of the fraction will always be a very bad way to represent bitcoin’s impact, and will only serve to demonstrate the pervasiveness of Bitcoin misunderstandings or the dishonesty of the authors.

BBC Claim:

The complaint also accuses us of using transaction and payment interchangeably, but the body of the BBC article, like Mr de Vries'; study, only uses the word transactions.

The word 'payment'; is used only in the headline, where it is particularly important that language is accessible to a general reader. Headlines and text are intended to be read in conjunction with each other, so we do not agree that readers would have been confused. It is worth noting that Mr de Vries tells us he doesn't have an issue with the headline.

Our Response:

This is still not acceptable. The interchangeable use of transaction and payment in BBC articles misconstrues what these terms mean in a Bitcoin framework – as well as in traditional finance. The international settlement networks that work in dollars, euros, yen, and other currencies regularly bundle multiple payments into single transactions to be divided between beneficiary accounts on arrival – this process is called gross settlement (White, 1998). This is done for efficiency and cost reasons. It is the same on the Bitcoin network (River, 2024). Because Bitcoin transactions are programmable and extensible, a single transaction can include large numbers of payments. Indeed, a transaction could take a single input and send multiple payments to any number of wallets at certain times or upon receipt of certain inputs.

The terms are similar but not interchangeable. The idea that BBC readers can’t comprehend the difference is an indictment not of the readers themselves, but of your view of them.

BBC Claim:

We do not agree that the BBC is ';demonising Bitcoin'; as you suggest. As an impartialnews organisation, we do not take a view but aim to report on topics we feel will be of interest to readers, reflecting a range of views.

Our Response:

Your articles exclusively quote interviewees who discuss negative aspects of the stated claims. At what point did you seek the comment of a person on the other side of the Bitcoin fence who could offer a different perspective?

BBC Claim:

We reject the notion that Mr de Vries may have a conflict of interest simply because he works for the Dutch Central Bank.

Our Response:

The Dutch Central Bank has been very vocal in opposing digital assets in general and Bitcoin in particular. Please find the following list of publications, news, and summary statements from the Dutch National Bank (DNB):

Everything you should know about cryptos - “At DNB, one of our core tasks is to ensure financial stability. Cryptos are a potential danger to this Stability.”

Digital currency issued by central banks can protect public interests in

payment systems.

All that glitters is not gold in crypto-assets

To improve is to change - “Grumbling about novelties like Bitcoin and

TimeCoin”

Everything you should know about cryptos - “While unbacked cryptos are

unsuitable as a means of payment, they are attractive for gambling.”

Proper regulation indispensable for risky cryptos - “Clearly, unbacked

cryptos like Bitcoin are not suitable for use as money.”

Speech Steven Maijoor - Banking in the digital age: seizing opportunities, managing risks - “The most recent risk assessment shows that markets for crypto-assets … could reach a point where they represent a threat to the stability of the global financial system.”

We’ll leave you to speculate whether there might be a professional benefit to being an outspoken and established voice against Bitcoin inside the DNB.

END OF REBUTTAL

Conclusion

Our investigation into the BBC's report on bitcoin's supposed water usage highlights a wider issue of bias and misinformation in media coverage of cryptocurrency. By collaborating with DARI, we aim to correct these misconceptions and advocate for more informed and balanced reporting.

We urge the BBC to acknowledge their oversight and rectify the misleading information.